Current Position

- Inflation figures for June revealed an unexpected fall in the Consumer Prices Index (CPI) rate to 2.6% after seven months of rising rates and May’s high of 2.9%. Possibly, inflation is now at, or close to, its post-Brexit-vote peak, and an interest rate rise may not be forthcoming after all.

- The recent inflation dip was largely the result of falling oil prices, which offset rising food and import costs. Inflation remains above its 2% target and only time will tell whether this result will be sustained or a blip in an otherwise upwards trend.

- However, this higher inflation, increases in the US Federal Reserve’s central rate and the prospect of a ‘softer’ Brexit following the recent general election result, are all sound reasons why an interest rate rise in the UK could still occur later this year.

- A rise after such a long period of low interest rates would no doubt be viewed as a positive sign of economic health, but it presents new challenges, and new opportunities, for those owning investments whose valuations are linked with interest rates.

Why have rates been so low for so long?

- The credit crunch of 2008/2009 thrust the UK banking system into a severe funding shortage, restricting its ability to lend.

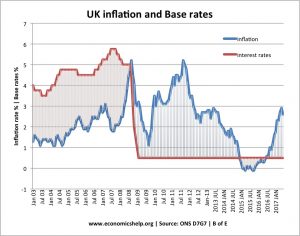

- Consequently, consumer demand & house prices fell along with economic growth. The Bank of England acted promptly to boost liquidity by cutting the bank rate to 0.50% and by injecting money into the economy through ‘quantitative easing’. (the purchase of government bonds).

- Interest rates were once again cut, this time to 0.25% in August 2016 to help shore up the anticipated economic fallout from the EU referendum.

- Lower interest rates create the environment to spend by making borrowing cheaper, and provide no motivation to save due to poorer returns.

- Before long, borrowers chose to use the extra money to start paying down debts and savers with a set goal in mind, say building up a deposit for a house, have combatted low returns on savings by cutting spending further to make up the shortfall.

- Furthermore, interest rates have largely been low for such a long period because economic indicators have remained subdued. The economy has become increasingly reliant on cheap money, and quantitative easing has proven difficult to unwind.

Why might higher inflation trigger an interest rate rise?

- Interest rates are generally used to control inflation and it is increasingly difficult for the bank’s Monetary Policy Committee (MPC) to sustain a ‘wait and see’ approach.

Source: Bank of England and Office for National Statistics.

- Until June’s inflation figures, there has been a clear upward trend in inflation since late 2015, which accelerated after the Brexit vote, taking us to the highest rate for over five years in May.

- The MPC inflation report forecasts that CPI will rise further above the target in the coming months peaking at a little below 3% in the fourth quarter of the year before falling gradually.

- Inflation is forecast at 2.8% for 2018. If it is prolonged above the 2% target it could become embedded through underlying ‘cost push’ pressures (where general price levels rise due to increases in the cost of wages and raw materials). This will not be helped by a government lacking political authority to control demand via fiscal policy. (where the government adjusts its spending levels and tax rates to monitor and influence the economy).

- In these circumstances, interest rates could rise over 2017-2020 anyway.

Will the UK follow the US?

- The US Federal Reserve (Fed) has raised its central interest rate in recent months. It now sits at 1.25% and is expected to increase it once more in 2017, and again in 2018. This, coupled with accelerating global growth, will also put broader pressure on UK rates to rise as UK interest rates tend to broadly mirror those of the US over time.

What about sterling?

- It is likely the drop-in sterling that followed the announcement of June’s inflation figures is short lived, and sterling may rise back towards its pre-referendum levels.

- Why? The government has a slim parliamentary majority. Therefore, it will be politically difficult to control demands for higher public spending or impose higher taxes. This is likely to result in the annual deficit and government borrowing being higher for longer. This could in turn drive up interest rates over time.

- Also, there is a probability of a ‘softer Brexit’ in which the UK manages to sustain favourable terms of trade with the EU in exchange for trade-offs around three other Brexit factors: annual payments, immigration, and sovereignty.

How will higher interest rates impact Investments?

- Rising interest rates bring both opportunity and risk. In general terms, developed equity markets tend to look over-valued at present. In the United States in particular, price to earnings (P/E) ratios are at historic highs, profits as a percentage of GDP have reached record levels, and the dollar is strong against a Brexit-weakened sterling.

- UK equities too have fared remarkably well since the Brexit vote, as the weakening currency bolstered overseas earnings. But we need to be wary of relying on further sterling depreciation as we get deeper into the Brexit negotiations.

- However, ‘Emerging Markets’ now appear good value compared to developed markets and they could offer the prospect of higher growth potential and superior opportunities going forward.

- As always, we believe investors should remain focussed on the medium to long term, shutting out market noise associated with the above events. Through our research at Loughtons, supported by the expertise of Morningstar, we focus on the intrinsic value of a particular asset. We continue to assess the quality of any investment opportunities which come about as the result of our investment process and strict fund selection criteria. A long-term outlook when investing is clearly desirable, as short-term expectations can turn out to be unrealistic where events cannot be anticipated.

- Therefore, active management remains important and generally volatility can be partially mitigated by diversifying investments across a broad range of asset classes that include equities, commercial property, fixed interest securities (bonds) and cash to spread risk even further.

- We will always look to ensure that our clients have a portfolio that reflects their requirements (attitude to risk and timeframe for investment) whilst considering what the impact the current stage in the economic recovery has on their exposure to various assets.

For clarification of any points discussed above and any future independent advice regarding your own financial planning, please do contact us on 01626 833225 or email [email protected]

Important Information

The views and opinions contained herein are those of Loughtons Independent Financial Advisers and may not necessarily represent views expressed or reflected in other economic communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Loughtons Independent Financial Advisers does not warrant its completeness or accuracy. No responsibility can be accepted for errors of fact or opinion. This does not exclude or restrict any duty or liability that Loughtons Independent Financial Advisers has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system.

Loughtons Independent Financial Advisers is a trading name of JPRS (South West) Limited. JPRS (South West) Limited is authorised and regulated by the Financial Conduct Authority.