Around the world, headlines in early 2020 have been dominated by the outbreak of coronavirus in China. As the virus has spread globally, taking thousands of lives, it has dealt a significant blow to global stock markets. But despite the clear impact that the epidemic has had in China, and now more globally, are global investors right to be quite so worried about its long-term effect?

At times like this, there is inevitably a temptation to panic. After all, if the coronavirus causes fatalities on a large scale, it would not only be tragic, but the implications for the global economy would be profound.

In a worst-case scenario, we could see a global economic recession leading to much lower corporate profits and many companies failing altogether. However, we must keep perspective. This is not the world’s first deadly epidemic. Nor is it the first-time stock-markets have been moved by one. During the past decade, share prices were affected by viral outbreaks of Zika and Ebola – twice, among several others. However, historic patterns show that the effects have often proved temporary, with only minimal long-term impact, if any.

If we consider global equity performance (as measured by the MSCI All Country World Index of the world’s largest listed shares) after previous epidemic outbreaks, we see that any effect over a one-month period did not persist longer term. One month after the 2014 Ebola outbreak, for instance, global markets were down by 0.1%, but they were up by 4.4% after six months. After the 2018 Ebola outbreak, the MSCI ACWI was down 7.5% after one month but only down 3.5% over six months.

Of course, there will have been other factors driving markets during these periods, as there are today. Nonetheless, it shows how initial concerns can abate over time, perhaps as the picture becomes clearer and the worst-case scenario is averted. Investors should also be clear not to conflate temporary market falls with permanent losses.

We cannot know how the coronavirus will continue to affect markets, and we cannot rely on the past as any guide to what will happen this time. Remember, past performance is no guide to future performance.

Keeping a long-term perspective

A key lesson from the sharp market fluctuations that have accompanied past epidemics is that panic selling can prove costly. If you had sold your investments during earlier outbreaks and then missed out on the subsequent recovery in prices, you would have likely ended up worse off. After all, it is notoriously difficult to try to time the market and buy back in at the right moment.

For professional investors and fund managers, however, market turmoil created by ‘episodes’ like this can provide opportunities to generate returns for their clients. By staying objective and focusing on the fundamentals, they can invest in long-term value opportunities where they arise.

We may not know how the coronavirus will further shape global markets, but we can learn from previous mistakes. Rather than getting caught up in the initial panic, it is important to keep perspective and focus on your longer-term goals.

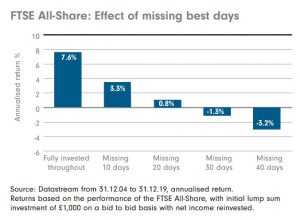

The information below illustrates the potential effects of missing out on the best days in the markets i.e. if an investor was to crystallise losses now and miss out on future market recoveries.

Key points to keep in mind are:

- When stock markets become volatile, it is usually best to resist making changes to your long-term investment strategy.

- It is too easy to miss the best gains when you try to time the stock market.

- Time, not timing, is the key to investing.

Volatility

Volatility is an investment term for when the stock market experiences periods of unpredictable, and sometimes sharp, rises and falls. People often think about volatility only in connection to dramatic drops in prices, but it can also refer to sudden rises as well. So, it’s really just a way of describing a market that’s going through some turbulence.Volatility is caused by a wide range of economic and political factors. From news affecting a particular industry sector, to government policy changes, political tensions or upheavals; anything that creates uncertainty and causes some investors to sell and others to buy can lead to volatility. In a volatile market prices aren’t always an accurate reflection of real worth. A sudden swing up or down can make an investment suddenly seem worth more or less than it really is over the long term.

Volatility is perfectly normal and is inevitable in a healthy market, and every long-term investor will experience it from time to time. Changes in the prices of stocks are natural in a functioning market. The value of individual companies can go up and down over time as their particular industries become more or less important, and policies and governments change every few years. So it’s important to be comfortable with the idea of seeing the market change. By being prepared for volatility at the start of an investment journey means you are less likely to be surprised by short-term events and stay focused on your long-term goals.

Our Approach

We will continue to work with you to assess your objectives and ensure you have a well-balanced portfolio that matches your appetite for risk and capacity for loss. We will consider what the impact the current stage in the economic cycle has on your exposure to various assets. Remember, volatility can be partially mitigated by diversifying investments suitably across a broad range of asset classes.

For clarification of any points discussed above and any future independent advice regarding your own financial planning, please do contact us on 01626 833225 or email [email protected]

Important Information

The views and opinions contained herein are those of Loughtons Independent Financial Advisers and may not necessarily represent views expressed or reflected in other economic communications, strategies or funds.

This post is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Loughtons Independent Financial Advisers does not warrant its completeness or accuracy. No responsibility can be accepted for errors of fact or opinion. This does not exclude or restrict any duty or liability that Loughtons Independent Financial Advisers has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system.

Loughtons Independent Financial Advisers is a trading name of JPRS (South West) Limited. JPRS (South West) Limited is authorised and regulated by the Financial Conduct Authority.