Stock-Markets don’t like uncertainty, and the coronavirus is having an effect on global markets and economic growth. Regionally, it was the Asian markets which have seen the greatest falls initially. However, this slump was followed by a rally that made back most of the losses.

But the spread of the virus outside of China and the potential for broader disruptions to both activity and demand has resulted in downturns in global markets across the US, UK and Europe this week.

While demand for goods and services has so far held up outside of China, the disruption to global supply chains (exports) running through China, Korea and, potentially, Japan is likely to take a toll on production and if this continues into the second quarter of 2020, this could affect the already weakening manufacturing sectors, with implications for jobs and the wider global economies.

Luxury goods, leisure and holiday firms have seen their share prices fall significantly this year. Sectors which are reliant on trade to distribute their products are also at risk. Car makers and industrials rely on the free movement of components such as parts or materials in their construction. If borders are closed and sea tankers are grounded, this could impact supply chains.

The Chinese economy is already under strain. Industry, the production of goods for sale or export, makes up 41% of its Gross Domestic Product (GDP) and if factory workers required to convert raw materials are unable to travel, this will inevitably slow.

Entertainment, retail and tourism services, are responsible for 52% of GDP. Global corporations are banning employees from visiting China for the foreseeable future and many major airlines have cancelled flights. It’s not will coronavirus impact Chinese growth, but how long the impact lasts.

Chinese GDP is worth $14 trillion and makes up around 16% of the global economy. A slowdown in China will impact the global economy. The National Institute of Economic and Social Research forecasts GDP growth of 5.9% for China this year, resulting in global growth of 3.1%. These figures are likely to be weakened by current events, particularly if coronavirus becomes pandemic.

What could investors do?

While there’s no doubt coronavirus will continue to impact markets in the short term, that doesn’t necessarily mean long-term investors should be overly concerned. Timing the market is notoriously difficult and trading on news events can often lead to bad outcomes. Panic selling often locks in losses and getting back into the market is often hard to do.

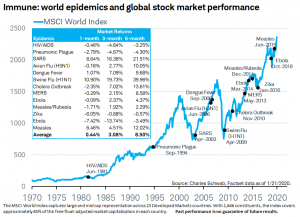

China has shown repeated her ability to shrug off even the most persisten issues in the past, as the chart below illustrates:

Behavioural finance shows us that selling at the top and buying at the bottom goes against our instincts but is exactly what you should do to maximise your chances of investing success. Of course, there’s no way of knowing when or where the bottom will be, and volatility can be tough to endure. All investments rise and fall in value, so you could make a loss.

For our investors, with a 10-plus year view, we think the best course of action is to do nothing and stick with it. For example, within four years both the FTSE 100 and the S&P 500 had shrugged off the losses of the global financial crisis of 2007-2009. There are no guarantees this will be repeated.

Coronavirus aside, we will continue to assess your objectives and ensure you have a well-balanced portfolio that matches your appetite for risk and capacity for loss. We will consider what the impact the current stage in the economic cycle has on your exposure to various assets. Remember, volatility can be partially mitigated by diversifying investments suitably across a broad range of asset classes.

For clarification of any points discussed above and any future independent advice regarding your own financial planning, please do contact us on 01626 833225 or email [email protected]

The views and opinions contained herein are those of Loughtons Independent Financial Advisers and may not necessarily represent views expressed or reflected in other economic communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Loughtons Independent Financial Advisers does not warrant its completeness or accuracy. No responsibility can be accepted for errors of fact or opinion. This does not exclude or restrict any duty or liability that Loughtons Independent Financial Advisers has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system.

Loughtons Independent Financial Advisers is a trading name of JPRS (South West) Limited. JPRS (South West) Limited is authorised and regulated by the Financial Conduct Authority.